The Chemours Company CC recently broke ground on a new $93-million mining facility on land leased from Camp Blanding in Clay County, FL.

The project will use mining technology that reduces environmental impact. Mobile Mining Units (MMUs) will also be used to reduce dependency on legacy mining processes to bring down emissions and dust levels, and make it safer. Moreover, the Trail Ridge South mining operations will recycle 98% of the water used in the mineral transport and separation processes and together the units will aim for sustainable solutions.

The expansion project will create an additional 50-75 positions and it is expected that there will be a positive spillover effect on surrounding areas as well. The construction of the project is expected to start this month. The company’s mining operations will allow it additional access to high-quality concentrated deposits of titanium and zircon minerals used in the manufacturing of its Ti-Pure titanium dioxide.

Chemours believes that through mining projects it can prove its ability to extract essential minerals in an environment-friendly approach. The expansions are expected to act as boons for regional economic prosperity. The company aims to guarantee that the process is environmentally sustainable, thereby ensuring a safe, healthy and clean Florida for future generations.

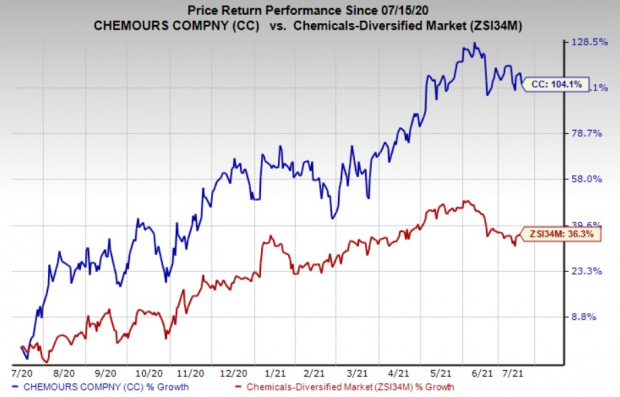

Shares of Chemours have surged 104.1% in a year compared with the industry’s growth of 36.3%. The estimated earnings growth rate for the company for the current year is pegged at 63.6%.

Image Source: Zacks Investment Research

In its last-quarter earnings call, the company said that it expects adjusted EBITDA between $1 and $1.15 billion for 2021. It also anticipates adjusted earnings per share between $2.84 and $3.56 for the year, up from the prior view of $2.40-$3.12. The company also expects a free cash flow of more than $450 million for the year.

The Chemours Company Price and Consensus

The Chemours Company price-consensus-chart | The Chemours Company Quote

Zacks Rank & Other Stocks to Consider

Currently, Chemours carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the basic materials space include Orion Engineered Carbons S.A OEC, Avient Corporation AVNT and Cabot Corporation CBT, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Orion has a projected earnings growth rate of 79.8% for the current year. The company’s shares have surged 65.3% over a year.

Avient has a projected earnings growth rate of 64.2% for the current year. The company’s shares have appreciated 80.3% over a year.

Cabot has a projected earnings growth rate of 137.5% for the current year. The company’s shares have jumped 46.9% over a year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Cabot Corporation (CBT): Free Stock Analysis Report

Orion Engineered Carbons S.A (OEC): Free Stock Analysis Report

The Chemours Company (CC): Free Stock Analysis Report

Avient Corporation (AVNT): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

More Stories

What You Can Expect To Pay A Playa Del Carmen Realtor

Real Estate Agent Job Description

5 Steps To Being A Real Estate Negotiating Professional!