|

An LNG tanker entering Rotterdam harbor to dock at an LNG terminal. |

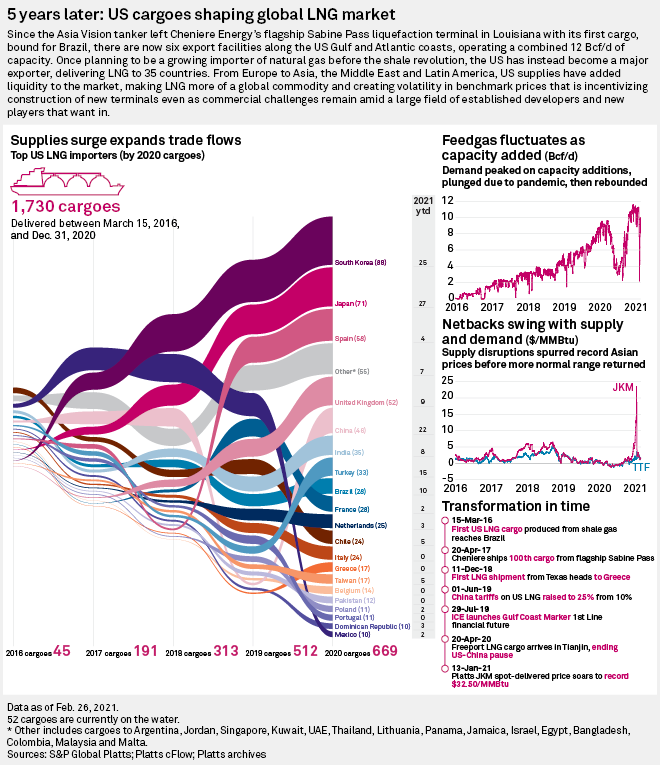

Some U.S. LNG developers expressed a renewed optimism in modern months that escalating desire among the planet prospective buyers in signing extended-phrase offer bargains will enhance the prospective buyers for commercially sanctioning new LNG export assignments in 2021, next a calendar year marked by a absence of final investment selections.

Far more than a dozen LNG builders in North The us are competing to advance their initiatives to building amid a solid rebound in LNG desire. But so significantly this calendar year, the pool of prospective U.S. LNG initiatives has previously gotten smaller, with Exelon Corp.-backed Annova LNG’s current selection to stop development of its proposed export facility in Texas, citing “variations in the world-wide LNG marketplace.” Analysts assume a lot more projects will drop by the wayside.

“There is home for two, 3 or 4 initiatives in the U.S.,” Jason Feer, head of business intelligence at Poten & Associates, explained in an job interview. “What that suggests is, you are heading to have to be just one of the most competitive.”

In 2020, only a single liquefaction task arrived at a closing expense choice, or FID — Sempra Energy’s Energía Costa Azul terminal on the West Coastline of Mexico. Other builders, specifically individuals with greenfield tasks that would be constructed from the floor up, have struggled to create sufficient professional assistance to safe financing for their jobs.

The issues contain pressure from prospective buyers to be adaptable on pricing and deal phrases as nicely as tension to convey down venture expenditures. Developers also experience mounting concerns over the offer chain emissions associated with U.S. LNG. And then there is Qatar Petroleum’s recent FID announcement on an enlargement capable of developing 33 million tonnes of LNG for every yr, a growth that could crowd out rival tasks in the U.S.

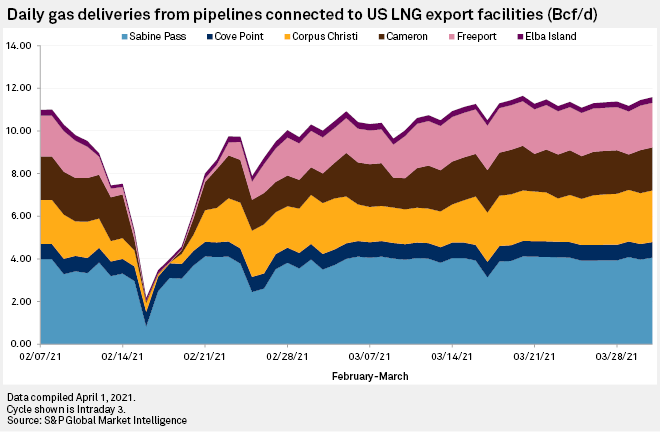

U.S. builders have even so pointed to sizeable volatility in benchmark fuel costs about the earlier 12 months as prompting a greater perception of urgency among the LNG customers to secure new materials. The 6 significant LNG terminals that are currently operational in the U.S. have viewed a sharp recovery from a weather-driven plunge in February to report-amount utilization, with feedgas deliveries remaining over 11 Bcf/d considering that mid-March as international gas rates continue on to support shipments of the gasoline headed into the summertime, according to pipeline move info from S&P Worldwide Market place Intelligence.

The subsequent is a compilation of updates to key U.S. LNG export tasks in current months.

Cheniere sees competitive edge in emissions tagging

Cheniere Power Inc., the greatest U.S. LNG exporter, is betting that the rebound in global marketplaces, desire from major Asian buyers and producing its carbon footprint additional clear will enable its professional attempts, which include a midscale prepare enlargement at its Corpus Christi LNG facility in Texas that could generate up to 10 Mt/y.

Cheniere lately introduced strategies to start providing shoppers with greenhouse fuel emissions knowledge for just about every of its cargoes, from wellhead to shipping place, commencing in 2022.

The organization is getting closer to completing the last of its currently-sanctioned LNG infrastructure. Cheniere lately completed a third liquefaction train at the Texas facility and stated a further liquefaction device at its flagship Sabine Go LNG facility in Louisiana could start out producing LNG by the stop of the 12 months.

Sempra’s Mexico LNG undertaking improvements

The estimated $2 billion Energía Costa Azul terminal is anticipated to start out manufacturing LNG in late 2024. Outside of that job, Sempra is the key proprietor of the Cameron LNG terminal in Louisiana. It is also the developer of the approximately 11-Mt/y Port Arthur LNG export terminal in Texas, which has an FID concentrate on in 2021.

Sempra’s President and CEO Jeffrey Martin claimed in late February that Sempra is considering funding section of the Port Arthur undertaking by taking on equity buyers in the project if required, but the aim is for Sempra Infrastructure Associates, a new device announced in late 2020 encompassing its LNG arm and the operator of gasoline and electrical power assets in Mexico, to self-fund Sempra’s LNG expansion designs. Sempra on April 5 reported it experienced agreed to offer a noncontrolling, 20% curiosity in the infrastructure unit to KKR & Co. Inc. for $3.37 billion in cash.

Building continues on 2 US LNG terminals

The developers of the two U.S. LNG terminals beneath construction — Venture Global LNG’s 10-Mt/y Calcasieu Pass terminal in Louisiana and the 18.1-Mt/y Golden Move LNG Terminal backed by Qatar Petroleum and Exxon Mobil Corp. — have noted continued development advancing their tasks.

Undertaking Global said in a March 17 filing with the Federal Electricity Regulatory Fee that Calcasieu Pass could be ready to ship its very first LNG cargo in late 2021, a 12 months in advance of timetable. The developer also explained to the best U.S. electricity regulator on March 31 that it is all set to start flowing gas on the pipeline that will source Calcasieu Move, stating it wanted the original gasoline provide to fee the LNG terminal’s ability era services.

Undertaking World expects full operations at Calcasieu Pass, which will be the country’s seventh big LNG export plant, to commence in mid-2022.

Golden Pass programs to have the to start with of 3 trains operational in 2024.

Apart from Calcasieu Go, Undertaking International is producing other jobs that contain the proposed Plaquemines LNG export facility in Louisiana, which would have a creation potential of up to 20 Mt/y. Undertaking Global has delayed its goal for closing financing till mid-2021, just after previously arranging to make an FID in late 2020.

NextDecade pursues carbon seize

Annova LNG’s March 22 announcement that it had canceled the development of its 6.5-Mt/y export facility still left two remaining LNG tasks proposed for the Brownsville Ship Channel in South Texas. Only a person — NextDecade Corp.’s up to 27-Mt/y Rio Grande LNG undertaking — has introduced any company long-expression contracts, a single offer for 2 Mt/y with Royal Dutch Shell PLC.

In late 2020, France’s Engie SA halted talks around a likely very long-time period offer for provides tied to the NextDecade task in what some sector officers interpreted as a opportunity warning shot that U.S. initiatives could endure from problems about methane emissions.

NextDecade for months has been pursuing means to lessen the emissions profile of the Rio Grande facility, which include an intense carbon capture and storage challenge the developer declared in March. NextDecade said it expects to make a FID on a least of two trains in 2021 and commercially sanction the carbon seize challenge shortly soon after.

The other Brownsville challenge is Glenfarne Group LLC’s Texas LNG Brownsville LLC facility, which would build 2 Mt/y of ability in its first phase. The personal U.S. expense company is also developing the proposed 8.8-Mt/y Magnolia LNG export terminal in Louisiana, following getting it in Might 2020. The developer estimated it could commercially sanction the services in the 2nd 50 % of 2021.

Tellurian looks upstream

Tellurian Inc. President and CEO Octávio Simões explained to S&P World-wide Platts on March 25 that the organization will not sanction its proposed Driftwood LNG project in Louisiana right up until it has secured sufficient upstream reserves for the 16-Mt/y very first stage of the task. Considering that Tellurian has only a compact acreage place in Louisiana’s Haynesville Shale, the developer would want to purchase a important total of drilling legal rights to meet its aim.

At whole progress, about half of the liquefaction terminal’s 27.6 Mt/y of approved capacity is envisioned to be utilised by the equity investment associates that Tellurian has been looking for. The remaining capability would be held by Tellurian to market on its very own.

Freeport LNG: Professional talks decide on up

Freeport LNG Improvement LP CEO Michael Smith claimed in March that the developer has seen renewed curiosity from customers in very long-term contracts tied to a proposed fourth liquefaction educate at its Texas export facility, adhering to major volatility in benchmark gas costs in 2020 and early 2021.

“There has been an overreliance on place cargoes in our market,” Smith stated at the CERAWeek by IHS Markit electrical power convention. “We’re looking at interest once more in prolonged-time period contracts for educate 4 due to the fact of it, and I consider other people will, far too.”

Freeport delayed an FID on prepare 4 in 2020 amid difficulties securing lengthy-term contracts, but the developer has claimed the project could still achieve an FID in 2021, dependent on marketplace ailments.

Lake Charles LNG carries on with no Shell

Vitality Transfer LP made a decision to move ahead as the sole developer of the proposed Lake Charles LNG export undertaking just after associate Shell pulled out of the venture in March 2020. But the developer claimed it would not goal an FID right until 2021, and it might reduce the sizing to two trains with a complete potential of 11 Mt/y.

US West Coast jobs continue being in limbo

The proposed 20-Mt/y Alaska LNG export terminal and Pembina Pipeline Corp.’s proposed 7.5-Mt/y Jordan Cove LNG export project in Oregon nevertheless face key headwinds, together with a absence of industrial assistance.

The point out-run Alaska Gasline Development Corp. is seeking to revive its battling exertion to build an LNG export terminal by shifting its focus towards a pipeline task that would produce organic gasoline generated from Alaska’s North Slope to the central part of the condition as a usually means of de-risking the project. To do that, it explained it will find federal clean vitality infrastructure funding to cover about 75% of the pipeline fees and will rely on a personal associate to address the relaxation of the project’s expenditures while spearheading its advancement.

Pembina executives stated in late February that they “unfortunately” can no longer predict when the organization will be capable to commercially sanction Jordan Cove. The undertaking has confronted important permitting issues at the federal, point out and neighborhood levels.

Commonwealth LNG charts distinct path

Commonwealth LNG LLC entered late into the area of U.S. LNG export developers when it applied for a federal Purely natural Gasoline Act permit for its 8.4-Mt/y export project in Louisiana in August 2019. The developer is pursuing a distinctive method to creating the commercial assistance it needs. Whether it operates should be evident in shorter purchase.

Commonwealth introduced a tender course of action soliciting bids to reserve off-just take from its job in January. Bids ended up thanks April 2, and the developer claimed it ideas to notify winners by the conclusion of the month right before executing contracts by the conclude of June.

Delfin deadline ways

The Delfin LNG job off the coastline of Louisiana has all major permits but has not gained an FID. FERC in July 2020 granted Delfin a a single-year extension to build linked onshore facilities, immediately after the developer told the regulator it wants extra time provided the “incredible situations the world financial state faces.”

S&P Global Sector Intelligence and S&P International Platts are owned by S&P International Inc.

IHS Markit is matter to a merger with S&P World pending regulatory and other customary approvals.

More Stories

What You Can Expect To Pay A Playa Del Carmen Realtor

Real Estate Agent Job Description

5 Steps To Being A Real Estate Negotiating Professional!