COVID-19 has formed the deal with of 2020, providing shockwaves by way of the financial state and sending substantially of the American workforce into sudden unemployment. Report-breaking hurricane and wildfire seasons have more impacted thousands and thousands of people’s daily life and finances throughout the place. Though there have been some indicators of economic enhancement in latest months, numerous Us residents go on to deal with hardships. Regardless of this, it seems that a significant quantity of people may well have still left revenue on the table by failing to assessment or update their insurance coverage procedures in reaction to the unprecedented situations of 2020.

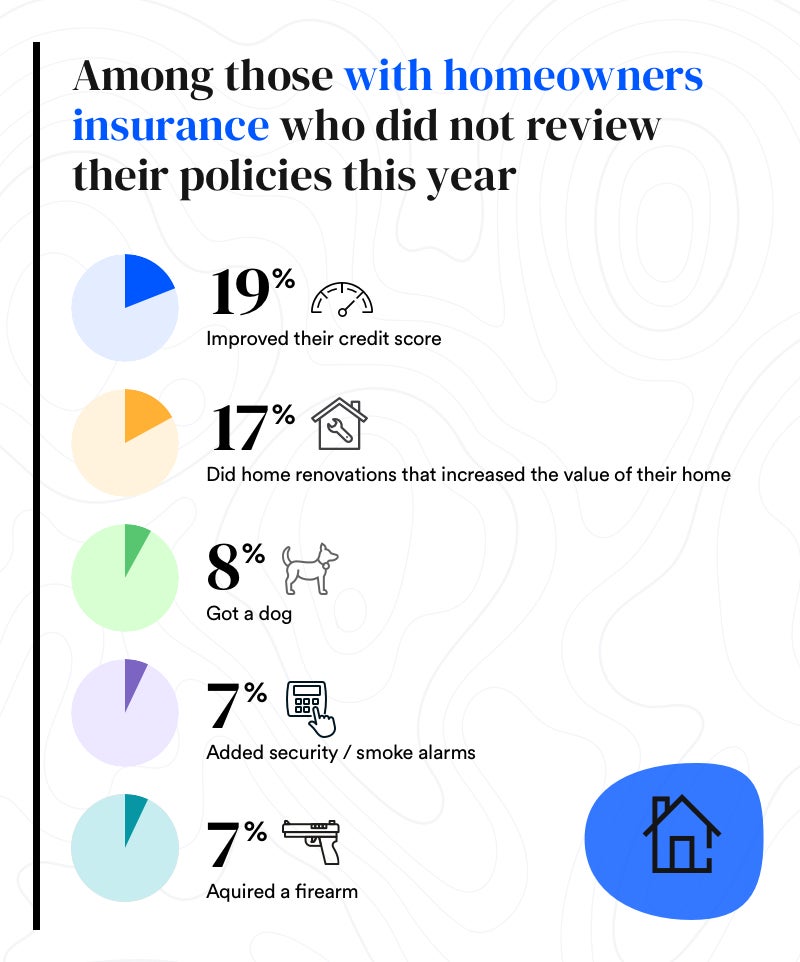

To analyze the significance of insurance plan insurance policies to a consumer’s total money perfectly-currently being, Bankrate partnered with YouGov to study just about 3,000 older people throughout the place in early November, inquiring what these policyholders did in different ways in 2020 that could have impacted their insurance coverage. We identified that about 46% of men and women with house coverage policies and 36% of all those with auto insurance policies did not review their 2020 procedures. Of those who did not evaluate their procedures, virtually half (48%) with house owners insurance plan and more than 1-3rd (38%) with vehicle insurance policy should really have completed so dependent on life style changes that could either help them save revenue or may well have caused them to require more coverage.

The study also revealed some fascinating tendencies about issues folks have finished in 2020 that could have afflicted residence and auto policy rates. Of the U.S. grown ups that Bankrate surveyed, 21% improved their credit history rating, 15% did property renovations, 12% stopped commuting to work, 8% got a pet and 7% additional new protection to their household.

As everybody heads into 2021, it may well be a great concept to pull out all those policies to evaluation them and make any alterations desired just before the new 12 months begins.

2020: A Yr of Adjust

In 2020, a person-3rd of American adults have turned to their retirement or price savings to pay out the expenditures, particularly those in decreased-money homes who ended up previously having difficulties. Pew Investigation Heart reviews that about 25% of American households have been impacted by job losses and layoffs this calendar year, building money tighter than ever as COVID-19 figures carry on to spike forward of an expected vaccine.

In accordance to the Environment Lender, as the pandemic progresses, the financial problems is presently apparent and signifies the greatest financial shock the earth has knowledgeable in a long time.

With dollars restricted for so many Individuals, folks are searching for methods to help save revenue anywhere possible. Even now, several may perhaps not have deemed the importance auto and home insurance policies can have to their total fiscal portfolio.

How Dwelling Coverage Premiums Could be Impacted

For many, their residences depict their largest asset as well as their optimum price. And numerous may well not comprehend what things to do and behaviors impression home insurance plan premiums. For instance, easy every day existence adjustments can decreased costs. For the 7% of study respondents with homeowners insurance policies who did not review their plan but extra new protection to their household, their coverage businesses would most likely have agreed to prolong extra policy savings in trade for the further defense.

Credit rating, just one of numerous elements that figure out premiums, is one more region exactly where shoppers can reduced insurance plan expenditures. The 19% of study respondents with householders insurance policies imagine their credit score enhanced in 2020 and would very likely be able to negotiate a lessen premium with their coverage companies likely ahead.

An exercise that can have either a optimistic or detrimental impact on home insurance plan premiums is home renovation. It depends what type of get the job done has been finished on the home — some renovations, these types of as putting in a new roof, can lessen rates, although other folks, these as incorporating a pool in the yard, generate costs up. Centered on study success, the 17% of respondents with property owners insurance who did not review their plan but accomplished dwelling renovations could be about or underinsured and not notice it.

Given that introducing animals to the household seemed to be a well-known exercise in 2020 as well, it is value noting that proudly owning particular doggy breeds can also drive household insurance policy expenditures up or stop home insurance vendors from covering you.

It’s a great notion for householders to look at their existing procedures and speak with their insurance policy suppliers to see where by they can preserve dollars, either now or in the 1st 50 % of 2021. It’s also sensible to test and see what sorts of functions may perhaps demand added coverage protection so that there are no surprises in the function of a assert.

How Vehicle Insurance plan Rates Could be Impacted

The quantity of time people expend on the street has improved drastically in 2020 as perfectly. Early on, the COVID-19 pandemic primarily cleared the roadways, and major car or truck insurance providers Allstate, GEICO and Progressive all noted a 30% lower in car insurance statements relevant to harmed residence and bodily injuries via mid-2020, according to Fitch Ratings. Some insurance policy providers dispersed refunds or extended discounts to policyholders mainly because of so several cars and trucks grounded at property. By means of the YouGov examine, Bankrate uncovered that many motorists did not consider benefit of all the financial savings that may have been obtainable to them. Nevertheless, even as tra

ffic stages start off to raise all over again to pre-pandemic ranges, there might nevertheless be some options for motor vehicle homeowners to save cash.

Pretty much 40% of surveyed Individuals with auto insurance documented that they experienced not reviewed their policy. On the other hand, far more than 20% who had not reviewed their plan believed that their credit history rating had improved. Related to property insurance policies, a credit score score is typically an essential element in identifying automobile insurance policies premiums.

Working from home can also lower car insurance policies charges. For the 14% of car coverage policyholders who have stopped commuting but still have not reviewed their car insurance policy, it’s possible they can decreased their automobile rates. Quite a few of these doing work from home given that the pandemic began will go on to do so into 2021, so it may be a superior notion to speak to your insurance policies company and inquire for a discount.

Who Reviews Your Plan, In any case?

Insurance policies suppliers employ folks to regularly critique and consider their customer’s insurance policies to be certain that they keep up with developments and charge suitable premiums. On the other hand, these persons do the job for the insurance company, not for you, which is why it’s vital to remain diligent with your procedures.

Our analyze displays that only 54% of home owners and 64% of auto coverage policyholders experienced reviewed their insurance policies procedures since the starting of 2020. Policyholders around 18 with a bigger income were being more probably to evaluate their house insurance policies, with 60% building in excess of $80,000 every year, when compared to 47% of house owners who make beneath $40,000. 64% of car policyholders above 18 across all earnings brackets were more most likely to have reviewed their car insurance policy, in contrast to just 36% who make down below $40,000.

Any person can gain from examining their insurance procedures to discover savings, but it might be specifically valuable for homes with reduced incomes. By cluing your provider into critical life style modifications, you could save a fortune in insurance policies rates and also potentially come across alternate protection that is additional suited for exactly where you are in everyday living.

The Base Line

This survey helps make one particular thing apparent: by not routinely reviewing their residence and car insurance procedures, policyholders are missing alternatives to preserve dollars and defend their most useful property. Insurance policies is an integral component of any monetary strategy mainly because lifestyle is entire of surprises. But even if you failed to acquire edge of some of the exclusive chances that 2020 offered to preserve revenue on insurance policies, it’s not way too late.

A lot of insurance policy companies have simplified the approach, making it simpler to check procedures with on line and mobile instruments. You can also assessment your insurance policies, file promises, observe progress and speak to shopper support for guidance. 2020 could have introduced new difficulties for numerous of us, but having a minute to critique household and automobile insurance policies guidelines could help you established yourself up for good results and savings in 2021.

Methodology

Bankrate.com commissioned YouGov Plc to perform the survey. All figures, except if otherwise said, are from YouGov Plc. The full sample size was 2,931 grown ups, such as 1,968 with home owners insurance policies and 2,441 with car insurance. Fieldwork was undertaken November 5 – 6, 2020. The survey was carried out on the web and fulfills rigorous high-quality expectations. It used a non-chance-primarily based sample making use of both equally quotas upfront during assortment and then a weighting scheme on the back stop created and established to present nationally consultant effects.

More Stories

Tenant’s Legal rights and Pets – The Landlord Vs Your Cat

This Is Why People Are Investing In Lightning Protection

The Real Estate Investing Secret Real Estate Investors Don’t Want You to Know About