By Rod Smyth, Chairman of the Board of Directors

SUMMARY

- Low interest rates and rising life expectancy are two major challenges for Financial Advisors and their clients.

- In the distribute phase, portfolios will likely need greater exposure to ‘risk assets’ such as stocks and higher yielding bonds to meet return objectives, in our view.

- Managing those risks is very important when finding the right balance between current income and growth of principal.

Clients in Retirement Needing Income

In a world where most people do not enjoy the benefit of a guaranteed pension, retirement becomes a personal responsibility. The goal for many investors is to maintain their standard of living in retirement with the peace of mind that their money will not run out. Furthermore, we believe retirees do not want to spend their golden years worrying about the monthly fluctuations in the stock market.

[wce_code id=192]

The challenge of providing a stream of income for retirement has changed dramatically for many reasons:

- Life expectancy is increasing. In the US, life expectancy has increased steadily from 68 in 1950 to 79 today, according to the United Nations, and they forecast it will rise to 84 by 2055. Therefore, the asset pool at retirement must be larger than has historically been the case.

- Few guaranteed pensions. Most employers no longer provide a guaranteed pension. In the ‘good ole days’ when many companies had guaranteed pensions, retirement income was your employers’ problem. Now with defined contribution plans (such as 401k plans), that problem has been shifted to employees who must build up savings and invest it themselves. Investors with insufficient savings are tempted to have excessive exposure to risky assets, trying to achieve unrealistic spending goals.

- Low interest rates on cash and bonds. Due to very low interest rates, we think a safe portfolio of bonds is unlikely to come close to providing enough after-tax, after inflation income for most of the investors we serve. For example: The yield on the standard benchmark bond index is around 1.5% as of June 25, 2021 (based on the Bloomberg Barclays U.S. Aggregate Index which includes Government, Corporate, and Mortgage bonds).

- High yield is often high risk: yields are usually high for a reason. Lower quality bonds, especially those rated below investment grade, offer higher yields to compensate investors for higher volatility and greater risk of default. Owning high dividend-paying stocks can also be riskier than you might think. Companies with high dividends can be highly indebted and can be concentrated in certain sectors, often those that have lower earnings potential.

- Lack of investing experience. Many retirees have little experience with investing, managing risk, and managing emotions. Dealing with the price swings of risky assets involves the following risks in our opinion:

- Emotional Risk: In our experience investors plan in 5 and 10-year time horizons, but sometimes succumb to fear and greed by reacting to current headlines. This can cause them to abandon well thought-out plans, made in a calm environment. We believe a critical part of the retirement planning process is to assess and periodically review risk appetite to build a plan that allows the retiree to weather market volatility. This also involves a realistic understanding of the potential longer-term tradeoff between returns and safety.

- Drawdown Risk: When risk assets fall significantly in price, monthly withdrawals can cause forced selling at unattractive levels risking the viability of the plan.

Generating a 3-6% after-inflation return in retirement.

In the current low interest rate world, we believe a retiree seeking a 3-6% return after inflation, with consistent monthly income, will need to invest a greater portion of their assets in more volatile investments to get the higher returns they seek. Let’s call these “risk assets”, which can include stocks, investment grade bonds, higher yield “junk” bonds, real estate, and other investments.

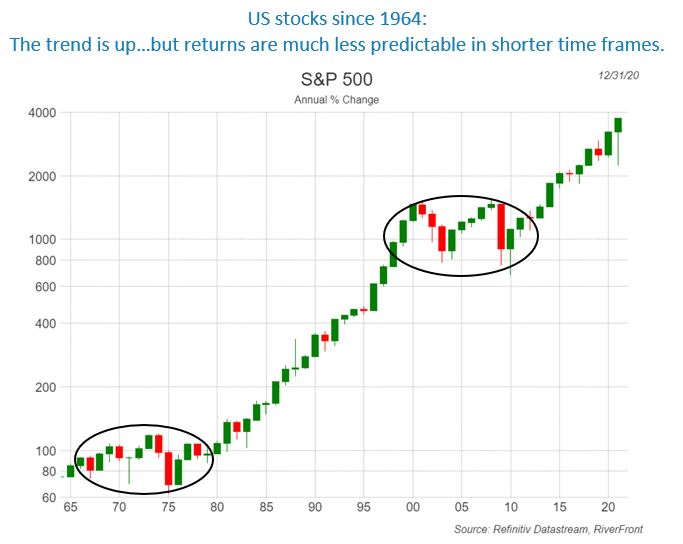

To give you a sense of the journey of a stock investor, the chart below shows annual price returns for the S&P 500 index of large US stocks from the beginning of 1964 to the end of 2020. While the price gains have been considerable -roughly 40-fold since 1964 – each red bar represents a declining year. The ovals show prolonged periods (10-15 years) where the index essentially went sideways, was very volatile, and had multiple down years. Some of the drawdowns in these timeframes were considerable with the index losing roughly half its value 3 times: 1973-1974, 2001-2003, and 2008. While it might be tempting to look at the overall returns to decide an appropriate allocation, we think it is just as important to consider the journey. Given enough time, stocks have historically been a rewarding investment, but those in the distribution phase have differing time horizons. Thus, the amount allocated to stocks throughout the retirement journey is a very important part of the distribution equation and one we think about when designing our portfolios.

The building blocks of a 21st Century Retirement Plan

Risk Assets: When constructing a retirement plan, we believe investors should use enough ‘risk assets’ to provide the required returns. Riskier assets require more careful selection and closer scrutiny. For example, when incorporating high-yield bonds, we think it is important to understand the specific risks of each bond, which may not be obvious upon cursory review. We believe these types of bonds can play an important role in boosting cash flow, but we also believe this is a decision that should be actively managed and monitored.

A Balanced Structure: We believe investors should ensure the portfolio has not only a stream of fixed income payments, but also a mixture of stocks that produce a combination of growing dividends and earnings. We tend to prefer companies with the greatest potential to grow dividends, rather than those with the highest starting yield, as we believe growth of income is important in the distribution phase. Also, companies in faster-growing sectors often reinvest their excess cash flow to expand and do not pay dividends. We do not want to exclude these stocks as we think they can play an important role in growing the retiree’s asset base.

Cash Reserve: We believe investors should hold a cash reserve that ensures retirement income can be drawn down during market corrections thereby minimizing stock sales during bear markets. Manage the cash reserve by selling some potentially overvalued, appreciated assets in good times to fund the cash pool. In bad times, portfolio income could also be supplemented by selling low risk, less volatile assets.

How RiverFront can help

While retirement is the end of the Accumulate or Sustain journey, it is the beginning of a potentially long Distribute phase as life expectancy continues to increase. At RiverFront, we believe investors will need to maintain a larger allocation to stocks in the distribution phase as long as the cash flow from bonds and money markets remains so low; and our portfolio solutions reflect this belief. This will likely involve bigger swings in quarterly portfolio values.

With the help of a financial advisor, a professionally crafted retirement plan can be tailored to the investors’ needs, and risk tolerance. We think our focus on portfolio construction, risk management, transparency, and consistent communication are critical elements in giving Financial Advisors and their clients the peace of mind to stick with the agreed plan.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Yield to worst is calculated on all possible call dates. It is assumed that prepayment occurs if the bond has call or put provisions and the issuer can offer a lower coupon rate based on current market rates. If market rates are higher than the current yield of a bond, the yield to worst calculation will assume no prepayments are made, and yield to worst will equal the yield to maturity. The assumption is made that prevailing rates are static when making the calculation. The yield to worst will be the lowest of yield to maturity or yield to call (if the bond has prepayment provisions); yield to worst may be the same as yield to maturity but never higher.

There are special risks associated with an investment in real estate and Real Estate Investment Trusts (REITs), including credit risk, interest rate fluctuations and the impact of varied economic conditions.

High-yield securities (including junk bonds) are subject to greater risk of loss of principal and interest, including default risk, than higher-rated securities.

Index Definitions:

Bloomberg Barclays US Aggregate Bond Index measures the performance of the US investment grade bond market. The index invests in a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States – including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than one year.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID1701822

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

More Stories

What You Can Expect To Pay A Playa Del Carmen Realtor

Real Estate Agent Job Description

5 Steps To Being A Real Estate Negotiating Professional!