The current market expects Valmont Industries (VMI) to supply a year-above-calendar year increase in earnings on higher revenues when it stories benefits for the quarter ended June 2021. This broadly-recognized consensus outlook is critical in evaluating the firm’s earnings photograph, but a powerful element that may impact its near-time period inventory price tag is how the true success review to these estimates.

The earnings report, which is predicted to be introduced on July 21, 2021, could help the inventory shift larger if these key numbers are much better than expectations. On the other hand, if they miss, the stock might move decreased.

While the sustainability of the quick cost adjust and foreseeable future earnings expectations will largely rely on management’s discussion of company conditions on the earnings phone, it’s value handicapping the probability of a optimistic EPS surprise.

Zacks Consensus Estimate

This infrastructure tools maker is expected to write-up quarterly earnings of $2.51 per share in its forthcoming report, which represents a year-in excess of-yr transform of +25.5%.

Revenues are predicted to be $815.63 million, up 18.4% from the 12 months-back quarter.

Estimate Revisions Craze

The consensus EPS estimate for the quarter has remained unchanged around the previous 30 days. This is in essence a reflection of how the covering analysts have collectively reassessed their initial estimates more than this period of time.

Investors ought to hold in brain that the route of estimate revisions by each of the masking analysts could not usually get reflected in the aggregate adjust.

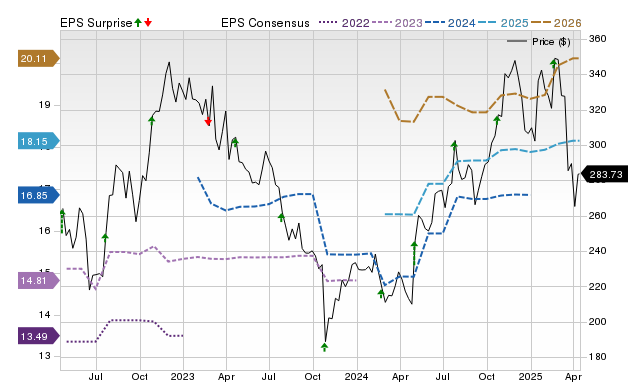

Price tag, Consensus and EPS Shock

Earnings Whisper

Estimate revisions forward of a company’s earnings release offer clues to the company situations for the period of time whose final results are coming out. Our proprietary surprise prediction design — the Zacks Earnings ESP (Expected Surprise Prediction) — has this perception at its core.

The Zacks Earnings ESP compares the Most Correct Estimate to the Zacks Consensus Estimate for the quarter the Most Exact Estimate is a much more new edition of the Zacks Consensus EPS estimate. The plan listed here is that analysts revising their estimates correct in advance of an earnings release have the newest details, which could most likely be extra precise than what they and other people contributing to the consensus experienced predicted before.

Hence, a positive or adverse Earnings ESP studying theoretically suggests the possible deviation of the real earnings from the consensus estimate. Having said that, the model’s predictive electrical power is significant for beneficial ESP readings only.

A beneficial Earnings ESP is a potent predictor of an earnings defeat, especially when mixed with a Zacks Rank #1 (Potent Buy), 2 (Get) or 3 (Maintain). Our study displays that shares with this combination produce a good surprise almost 70% of the time, and a good Zacks Rank actually improves the predictive power of Earnings ESP.

Remember to note that a destructive Earnings ESP reading is not indicative of an earnings miss out on. Our research displays that it is complicated to forecast an earnings defeat with any diploma of confidence for stocks with damaging Earnings ESP readings and/or Zacks Rank of 4 (Provide) or 5 (Robust Market).

How Have the Figures Shaped Up for Valmont?

For Valmont, the Most Precise Estimate is the similar as the Zacks Consensus Estimate, suggesting that there are no latest analyst views which differ from what have been deemed to derive the consensus estimate. This has resulted in an Earnings ESP of %.

On the other hand, the stock presently carries a Zacks Rank of #3.

So, this combination will make it complicated to conclusively predict that Valmont will conquer the consensus EPS estimate.

Does Earnings Surprise Historical past Hold Any Clue?

While calculating estimates for a firm’s potential earnings, analysts generally consider to what extent it has been equipped to match past consensus estimates. So, it can be worth having a seem at the shock historical past for gauging its influence on the impending selection.

For the very last documented quarter, it was predicted that Valmont would put up earnings of $2.12 for each share when it actually developed earnings of $2.57, providing a shock of +21.23%.

Above the past 4 quarters, the company has beaten consensus EPS estimates 4 times.

Bottom Line

An earnings defeat or pass up might not be the sole foundation for a inventory shifting bigger or decrease. A lot of shares stop up shedding ground inspite of an earnings defeat due to other elements that disappoint traders. Similarly, unforeseen catalysts support a number of shares attain inspite of an earnings miss out on.

That reported, betting on stocks that are anticipated to conquer earnings expectations does maximize the odds of good results. This is why it is worthy of checking a company’s Earnings ESP and Zacks Rank ahead of its quarterly release. Make confident to make the most of our Earnings ESP Filter to uncover the most effective stocks to purchase or offer just before they have reported.

Valmont doesn’t appear a persuasive earnings-defeat prospect. However, traders ought to pay back consideration to other variables way too for betting on this stock or remaining away from it ahead of its earnings launch.

Infrastructure Stock Boom to Sweep The united states

A significant drive to rebuild the crumbling U.S. infrastructure will before long be underway. It’s bipartisan, urgent, and inescapable. Trillions will be expended. Fortunes will be built.

The only issue is “Will you get into the correct shares early when their expansion probable is biggest?”

Zacks has introduced a Unique Report to assistance you do just that, and currently it’s totally free. Find out 7 specific organizations that search to gain the most from building and restore to roadways, bridges, and buildings, as well as cargo hauling and electricity transformation on an just about unimaginable scale.

Download Cost-free: How to Revenue from Trillions on Paying out for Infrastructure >>

Simply click to get this absolutely free report

Valmont Industries, Inc. (VMI): Absolutely free Inventory Assessment Report

To browse this write-up on Zacks.com click on below.

The views and views expressed herein are the sights and thoughts of the creator and do not always replicate those people of Nasdaq, Inc.

More Stories

Typical Workday of a Real Estate Agent

What You Can Expect To Pay A Playa Del Carmen Realtor

Real Estate Agent Job Description