Worthington Industries, Inc. WOR yesterday announced that it obtained some belongings of the U.S. BlankLight enterprise of Shiloh Industries, Inc. The transaction worth was $105 million.

It is worth mentioning in this article that Worthington’s shares attained 1.43%, ending the trading session at $67.28 yesterday.

Within the Headlines

As mentioned, the acquired belongings engage in delivering laser-welded answers, especially for shoppers in the mobility field. The options enable in lowering charges, product and pounds. It has 4 amenities, with two located in Valley City, OH, and just one every in Bowling Environmentally friendly, KY, (large gauge blanking facility) and Canton, MI. The acquired small business employed 200 folks.

In 2020, the acquired business generated revenues of $170.5 million and adjusted earnings before interest, tax, depreciation and amortization of $20.5 million.

It is anticipated that the facilities located in Valley Town, OH, and Canton, MI, will greatly enhance the abilities of Worthington’s joint undertaking relevant to laser-welded items — TWB Company, LLC. The addition of solutions like aluminum and curvilinear welded blanks will be useful for TWB Company. Then once more, the large gauge blanking facility will be aspect of the Metal Processing segment of Worthington.

The acquisition price of $105 million was settled by Worthington via out there dollars.

Other Inorganic Actions by Worthington

Worthington believes in obtaining corporations for growing its enterprise and merchandise choices. Also, it engages in divestments to strengthen shareholder worth.

In March, Worthington divested the Pomona, CA-primarily based Structural Composites Industries facility. The divestiture will assist it focus on mobility enterprises in Asia and Europe.

In January, Worthington offered off the oil & gasoline tools business. Having said that, the enterprise acquired Common Instruments & Instruments Enterprise LLC and PTEC Stress Technology GmbH in the similar thirty day period.

Zacks Rank, Price Effectiveness and Estimate Trend

Worthington at this time carries a Zacks Rank #2 (Buy). The enterprise is poised to advantage from its diversified organization framework, inorganic actions and sound demand for items.

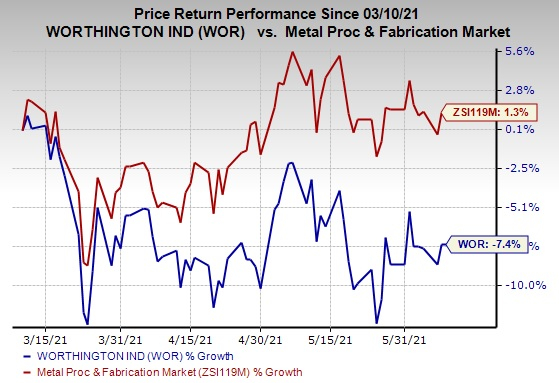

In the previous a few months, the company’s shares have decreased 7.4% as opposed with the sector’s expansion of 1.3%.

Picture Supply: Zacks Financial commitment Investigate

Picture Supply: Zacks Financial commitment Investigate

The Zacks Consensus Estimate of Worthington’s earnings is pegged at $3.90 for each share for fiscal 2022 (ending May well 2022), suggesting expansion of 5.4% from the 60-day-ago determine.

Worthington Industries, Inc. Price tag and Consensus

Worthington Industries, Inc. price-consensus-chart | Worthington Industries, Inc. Quotation

Other Shares to Think about

Three other best-ranked shares in the marketplace are Mueller Industries, Inc. MLI, TriMas Company TRS and The Timken Firm TKR. Whilst equally Mueller and TriMas currently sport a Zacks Rank #1 (Robust Acquire), Timken carries a Zacks Rank #2 (Invest in). You can see the total list of today’s Zacks #1 Rank stocks below.

In the past 60 times, earnings estimates for these shares have enhanced for the current yr.

Infrastructure Stock Growth to Sweep America

A enormous press to rebuild the crumbling U.S. infrastructure will quickly be underway. It is bipartisan, urgent, and unavoidable. Trillions will be expended. Fortunes will be created.

The only query is “Will you get into the appropriate shares early when their development potential is biggest?”

Zacks has produced a Exclusive Report to assistance you do just that, and right now it’s cost-free. Discover 7 exclusive companies that seem to achieve the most from design and repair service to roads, bridges, and properties, in addition cargo hauling and energy transformation on an virtually unimaginable scale.

Down load Cost-free: How to Gain from Trillions on Expending for Infrastructure >>

Simply click to get this free of charge report

Worthington Industries, Inc. (WOR): Cost-free Inventory Examination Report

Mueller Industries, Inc. (MLI): Free of charge Inventory Analysis Report

Timken Corporation The (TKR): Totally free Stock Evaluation Report

TriMas Company (TRS): Free Stock Examination Report

To read this write-up on Zacks.com click on right here.

The views and thoughts expressed herein are the sights and thoughts of the creator and do not essentially mirror individuals of Nasdaq, Inc.

More Stories

Real Estate Agents – What to Look for in a Mentor

Typical Workday of a Real Estate Agent

What You Can Expect To Pay A Playa Del Carmen Realtor